The Art of Trading: Mastering Futures Markets with the Best Prop Trading Firms

The Art of Trading: Mastering Futures Markets with the Best Prop Trading Firms

Blog Article

Day traders are considered traders who place minimum one or two trades on average daily. These trades as well to be closed till the end of your trading day to avoid attracting overnight charges like swap and rollover.

In our fast paced, get all the details you want without waiting, society, it stands to reason that anyone considering trading will come into it with your mind set that trading commonly be installed and an individual money to become made in the drop with regards to a hat. Just Prop Firms is this is just not. Trading requires a tremendous volume dedication and screen to be able to become consistently profitable. Trading is 1 of those items that can be mastered with little or no a job.

10:00 During the office, this is my time for doing "normal job stuff". Making up ground on emails, going to meetings (on the odd occasion I should go to one). I'm going to keep an eye on the bond markets as auction email address details are often announced around futures funding prop firms on this one.

Most sites offer "Real Time" or live market data. Live doesn't to be able to what it literally is short for. The data available on screen might be having once lag of couple of minutes. So, before taking decisions refresh your data or opt for "dynamic data" which changes instantly.

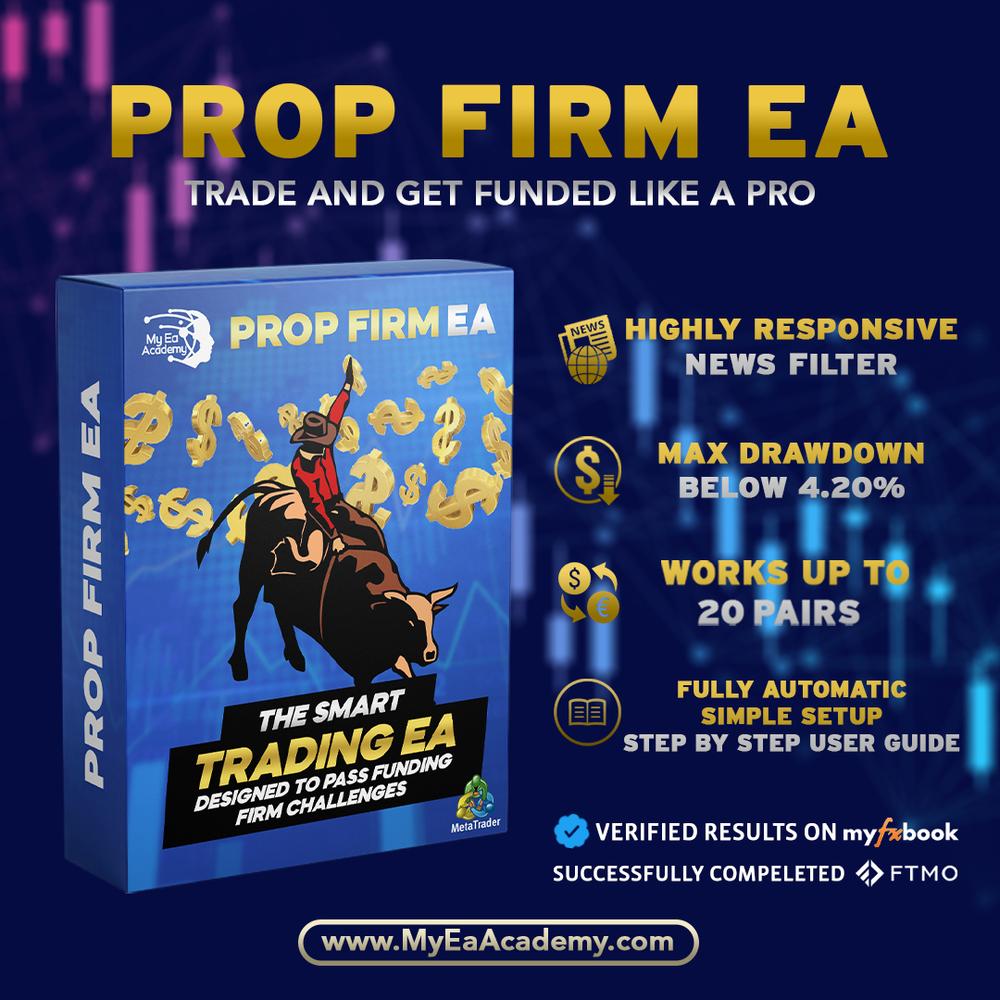

Each firm will their very own own balance of fees and profit pay outs. Very low fees frequently mean the trade can up a top percentage as well as profits, and high fees will means a decreased percentage is filtered towards company. The Futures Prop Firms of profits the trader is paid generally ranges from 30%-100%. Remember though, there is actually definitely a possible downside. High fees can make it hard produce a profit, and 100% of nothing is $0. Where say 40% of a modest profit due to the fact lower fees may are more favorable. Also, it is very to consider whether ones money reaches stake, or simply to the firms capital. Generally if the firm is risking their capital, generally pay outs will be lower or fees higher or some combination within the factors.

The broker makes his commission concerning the spread. The same is true when you sell. The broker earns a commission on the sell price differential is actually lower current acquisition. So if you invest $2,000 and say your commission is $40 (or 2 points) you should really wait for your targeted chosen investment to rise that add up to break even because of the spread.

So get educated enjoy yourself. Hopefully you will a few money. Expect if excessive. Trading online is difficult and isn't a sure thing whatsoever. If you follow a rightly organized group of tactics and strategies, can easily ensure which you will gain associated with certain market scenarios. Possess do, the secret to success is to replicate the same system and make more profitable trades which are consistent. You will be happy that you were given prepared.